Understanding a DOM chart is like peering into the intricate underpinnings of market dynamics. It captures the pulse of buying and selling activity in real-time, revealing not just the price at which assets trade, but also the hidden layers of market depth—those crucial buy and sell orders lurking just beyond the visible screen.

For traders and investors, these insights are invaluable. Yet, navigating a DOM chart can be daunting, filled with numbers and jargon that can overwhelm even the seasoned investor.

In this guide, we aim to demystify the DOM chart, breaking down its components and illustrating how to interpret the signals it sends. Whether you’re a newbie eager to grasp trading fundamentals or an experienced trader looking to refine your strategies, learning to read a DOM chart could be the key that unlocks a deeper understanding of market behavior. Prepare to dive into the depths of market analytics and emerge with the tools to inform your trading decisions.

The Structure of DOM Charts

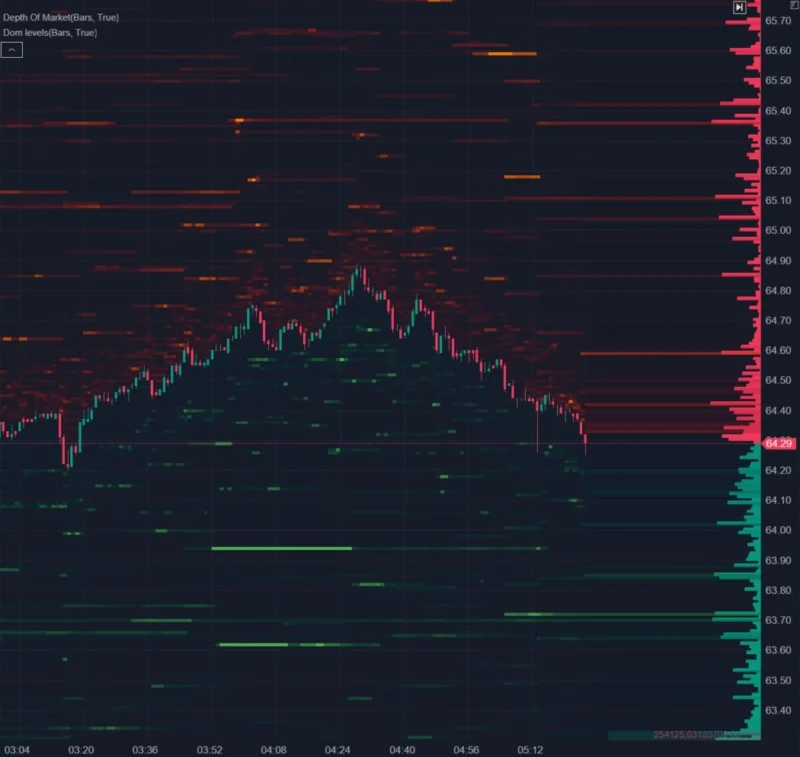

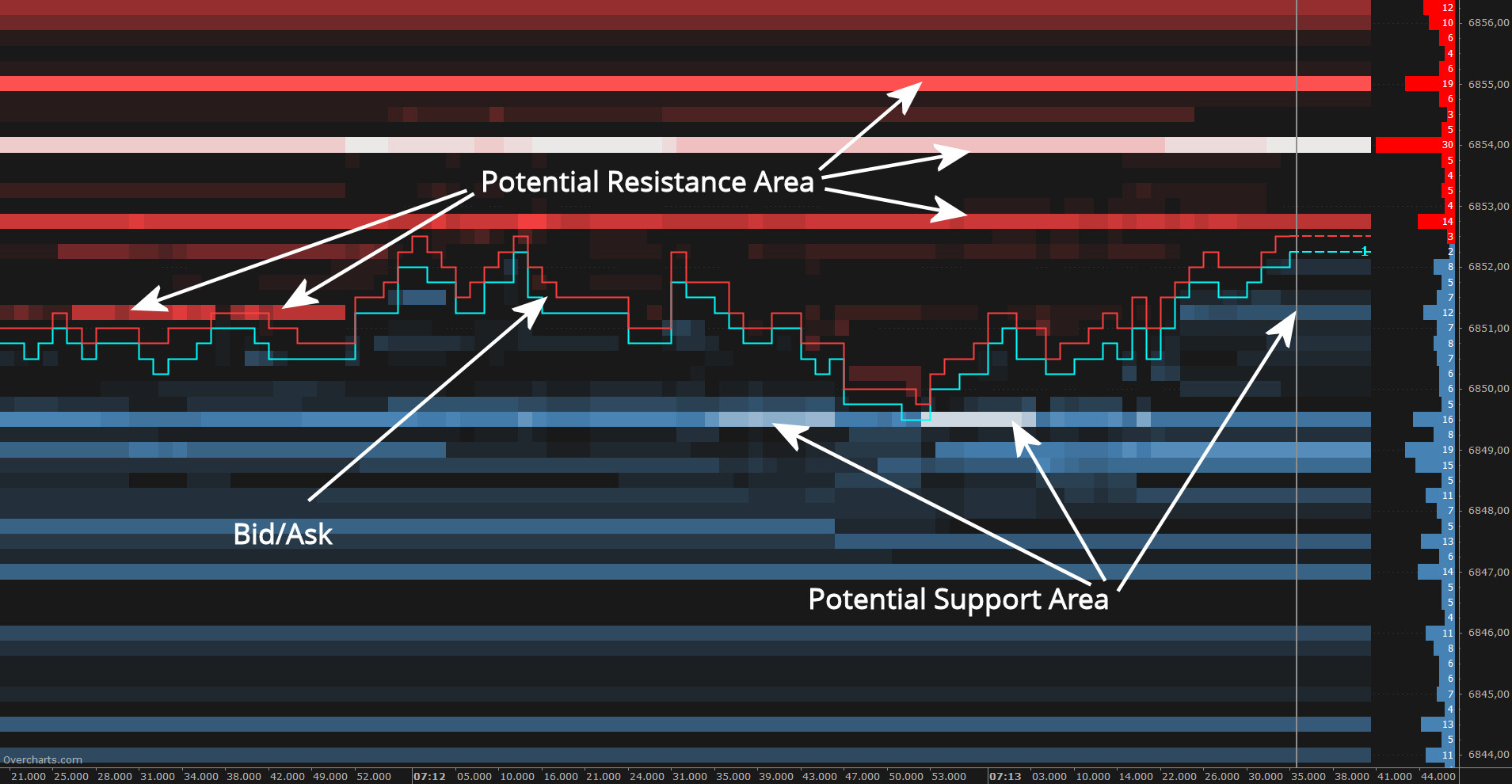

The structure of DOM charts is a fascinating tapestry woven from various layers of market data, each contributing to the vivid picture of market depth. At the heart of it lies the order book, where buy and sell orders are displayed in real-time, segmented by price levels. This visual representation not only showcases the liquidity available at each price point but also reveals the hidden intentions of market participants.

Each block of the chart acts like a window into trader psychology—higher concentrations of buy orders can indicate strong support, while clusters of sell orders may suggest impending resistance. As you delve into the chart, notice how the ebb and flow of volume fluctuates over time, giving clues about potential market movements.

The interplay of colors, often a blend of reds and greens, further enhances the narrative, highlighting urgency, opportunity, and caution in an ever-dynamic market. Understanding this intricate structure is key to unlocking the insights that can elevate your trading strategy and decision-making.

Reading Market Depth

Reading market depth is akin to peering into the intricate heartbeat of the trading landscape. It reveals a wealth of information beyond mere price charts, painting a vivid picture of supply and demand dynamics at any given moment.

By examining the Depth of Market (DOM) chart, traders can visualize active buy and sell orders stacked at various price levels. This arrangement hints at potential support and resistance zones—where the battle between buyers and sellers intensifies.

For instance, a thick cluster of buy orders at a certain price may indicate strong buying interest, while scattered sell orders higher up could suggest sellers looking to capitalize on price swings. An astute trader pays close attention to these patterns, identifying not just where price is likely to move, but also the underlying sentiment driving those movements.

Understanding market depth transforms you from a passive observer into an active participant, equipped to make informed decisions in the ever-fluctuating arena of trading.

Identifying Market Sentiment

Identifying market sentiment is akin to peering into the collective psyche of traders; it’s a nuanced dance of emotions, expectations, and reactions that play out in real-time. Analyzing a DOM chart allows you to grasp not just the numerical data but the very pulse of the market—who’s buying, who’s selling, and at what price.

Large buy orders might signal confidence, while a cascade of sell orders could suggest fear or uncertainty. Beyond mere figures, nuances can be gleaned by observing the speed and direction of transactions.

Are buyers pushing the price up frantically, or do they seem hesitant, sitting back as sellers dominate? A deeper dive into these dynamics unveils the underlying tensions at play, revealing peaks of optimism or valleys of skepticism that define the market’s mood. Thus, as you navigate through DOM data, remember: each number is a story, and together they narrate the current sentiment of the market.

Conclusion

In conclusion, mastering the art of reading a DOM chart is essential for traders aiming to enhance their market depth insights and make informed decisions. By understanding the intricate details of bid and ask prices, order sizes, and liquidity, traders can better anticipate market movements and improve their execution strategies.

As you develop your skills in analyzing these charts, remember that practice and experience will further enhance your ability to interpret the data effectively. With a solid grasp of DOM charts, youll be well-equipped to navigate the complexities of the trading world with greater confidence and precision.